Design Stock Exchange | HLD | Data Model | Reliability

Design a stock exchange, process buy and sell orders efficiently in memory

At the heart of any stock exchange system lies its ability to process and manage orders efficiently. An order in a stock exchange context is an instruction from a trader or investor to buy or sell a specific quantity of a financial instrument, such as stocks, at a particular price point. The stock exchange's order handling system is a complex, multifaceted entity designed to facilitate these transactions with precision and speed.

Order Types: The system must accommodate various types of orders, such as market orders, limit orders, stop orders, and more. Each type has unique characteristics and serves different strategic purposes for traders. For instance, a market order is executed at the current market price, while a limit order is set to execute only at a specified price or better.

Order Book: A critical component of the order handling system is the order book, which records all the active buy and sell orders for a particular financial instrument. This dynamic, constantly updating ledger is crucial for maintaining market transparency and efficiency. The order book must be managed in real-time, reflecting the rapid changes in the market as orders are placed, executed, or canceled.

Latency and Throughput Considerations: In stock exchanges, time is of the essence. The order handling system must be designed for low latency to ensure orders are processed almost instantaneously. High throughput is equally important to handle the massive volume of orders, especially during peak trading hours. The balance between latency and throughput is a key consideration in the system design, affecting the overall responsiveness and reliability of the exchange.

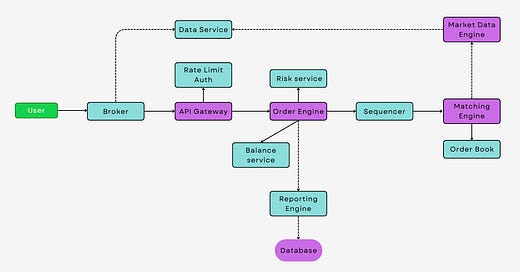

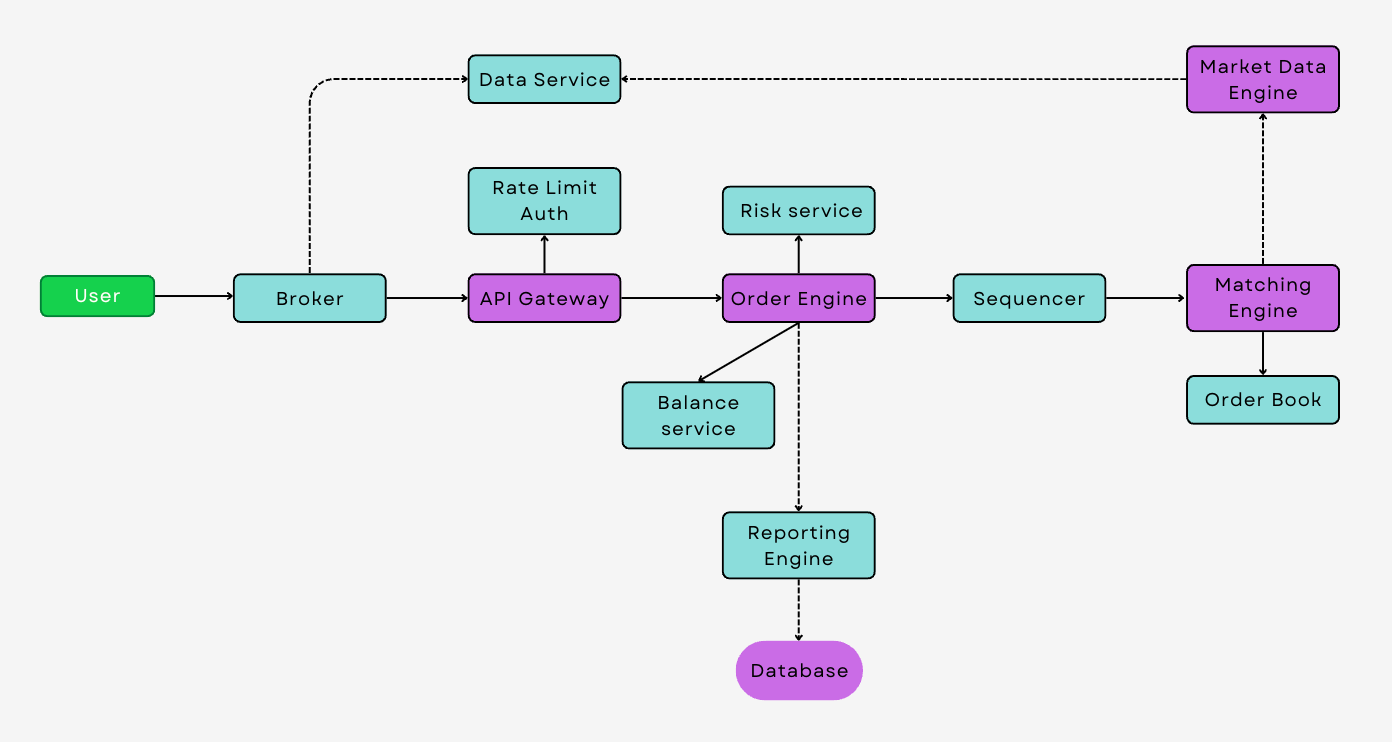

The Order Engine

The order engine is a crucial component of a stock exchange system. It is responsible for receiving and processing all incoming orders from traders. This engine must be highly efficient and capable of handling a massive volume of orders at any given time. It must also ensure that orders are processed in a fair and transparent manner, adhering to the rules and regulations of the stock exchange.

The order engine performs several key functions, including order validation, risk management, and priority setting. Order validation ensures that each order meets the necessary criteria before entering the system. This includes checks for sufficient funds or securities, correct order format, and compliance with trading rules. Risk management involves assessing the risk associated with each order and ensuring that it is within acceptable limits. Priority setting is crucial for determining the sequence in which orders are processed, usually based on factors like order type, price, and time of submission.

The Matching Engine

The matching engine is the core of a stock exchange system. It matches buy and sell orders from different traders, facilitating the execution of trades. The primary objective of the matching engine is to ensure that trades are executed in a manner that is fair, efficient, and in accordance with market rules.

This engine operates on sophisticated algorithms to match orders. The most common algorithm used is the price-time priority algorithm. This algorithm gives priority to orders with the best price (highest price for sell orders, lowest for buy orders) and, within the same price, gives priority to the orders that arrived first. This ensures a fair and orderly market where the most competitive orders are executed first.

The matching engine also handles complex order types, such as stop orders and iceberg orders. Stop orders are activated only when the market price reaches a certain level, while iceberg orders allow large orders to be broken into smaller, hidden orders to avoid market impact. These advanced features require the matching engine to be not only fast and reliable but also intelligent and adaptable to different market conditions.

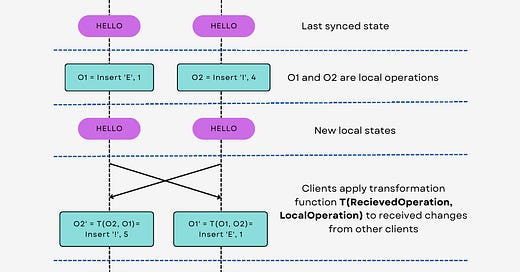

Event Sourcing

Event sourcing is a unique design pattern where changes in the application's state are meticulously stored as a sequence of events. Unlike traditional methods that focus on the current state of data, event sourcing involves recording the history of actions (events) that lead to the current state. This approach is especially beneficial in stock exchange contexts, where maintaining an accurate and comprehensive transaction history is essential for auditing, regulatory compliance, and ensuring operational transparency.

In stock exchange systems that embrace event sourcing, each transaction, be it a trade, an order, or any modification, is documented as an immutable event. These events are then stored chronologically in an event store, which becomes the ultimate source of truth. By replaying these events, the system can reconstruct the current state of any security or portfolio. This method not only bolsters data integrity and simplifies audit processes but also forms a robust foundation for asynchronous processing and the implementation of distributed systems.

Feel free to check a video version with more deep dive content.