Design a Payment System

How to design a payment system that keeps your transactions secure

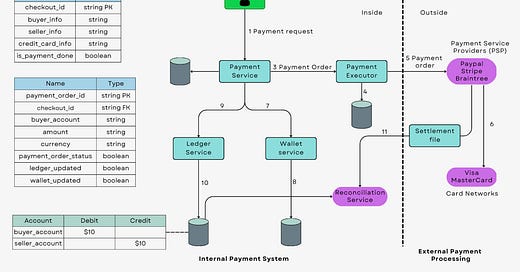

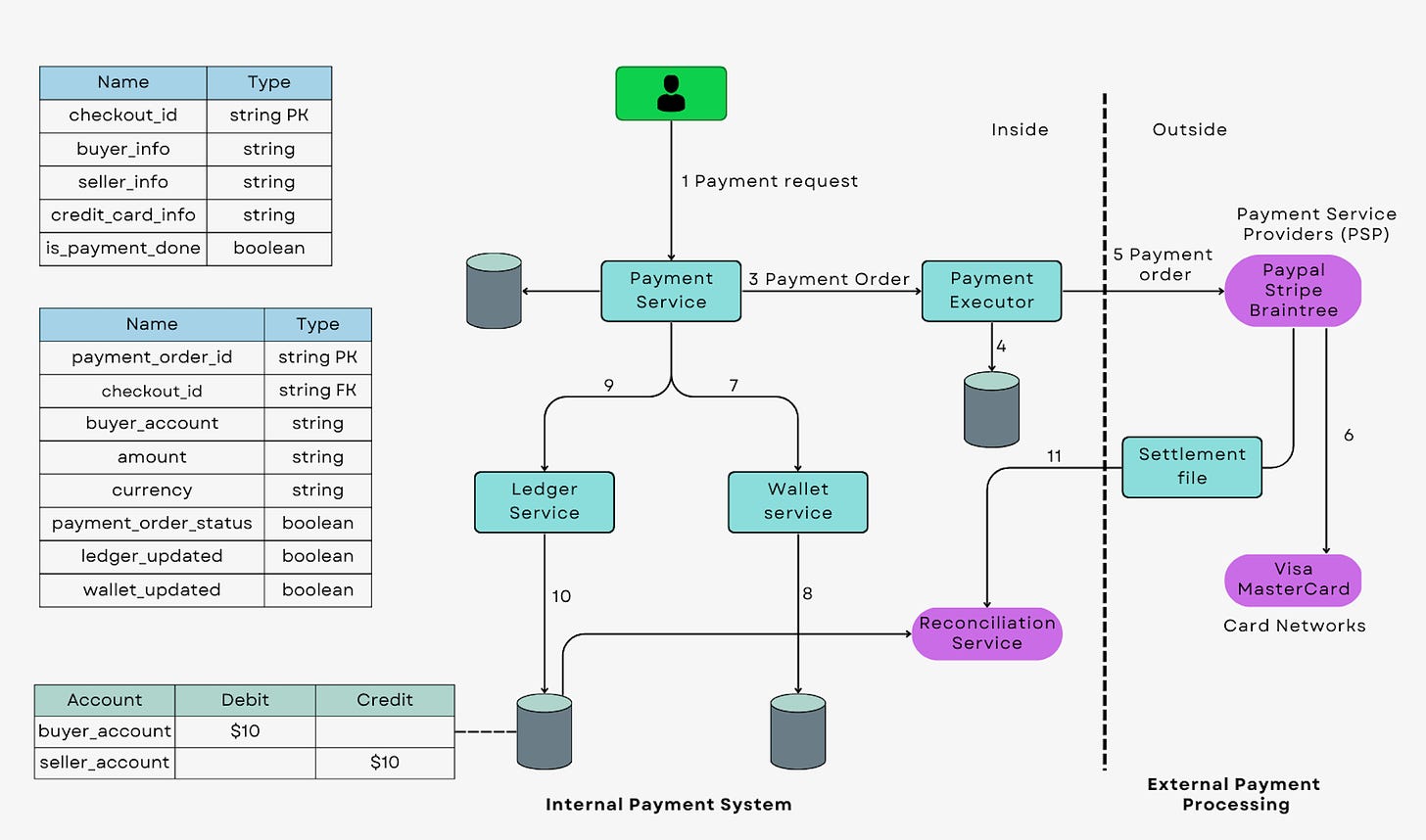

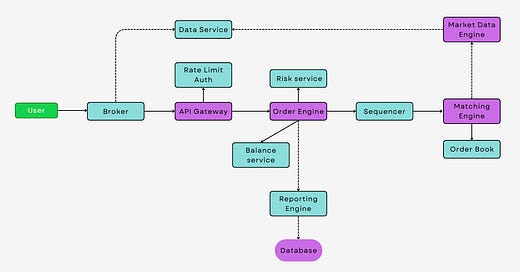

A payment system is a software-based solution that allows users to transfer funds from one account to another in a secure and efficient manner. The system should support various payment methods, such as credit cards, debit cards, bank transfers, and digital wallets. The payment system is typically made up of several components, including a payment gateway, a user interface, and backend systems.

Payment Gateway

The payment gateway is responsible for processing the payment and communicating with various financial institutions to transfer funds from the customer's account to the merchant's account. The gateway should be designed to be secure and scalable, with features such as fraud detection, encryption, and tokenization.

User Interface

The user interface should be designed to be user-friendly and intuitive, allowing customers to easily enter their payment details and complete the transaction. The interface should also support mobile devices, as an increasing number of users are making payments through their mobile devices.

The backend

The backend systems should be designed to store and retrieve payment data, as well as customer data, transaction data, and other relevant data. The system should be designed to be reliable, with redundancy and backup mechanisms in place to ensure that the system remains operational in the event of failures or disasters.

Design considerations

Here are some steps on how to think about it:

Determine the goals and requirements of the payment system: Before designing a payment system, it's important to define the goals and requirements. For example, the payment system may need to be fast, secure, reliable, and scalable. The system may also need to support various payment methods, such as credit cards, bank transfers, or digital wallets.

Choose a payment service provider (PSP): There are many payment processing platforms available that can handle the processing of payments. These platforms offer various features and functionalities, such as fraud prevention, recurring payments, and real-time reporting. Some popular payment processing platforms include Stripe, PayPal, and Braintree.

Integrate the payment processing platform: Once the payment processing platform has been selected, it needs to be integrated into the payment system. This involves setting up a merchant account with the platform and integrating the platform's API or SDK into the payment system.

Design a payment system: The payment system itself needs to be designed, which involves creating the user interface, backend systems, and databases. The user interface should be designed to be user-friendly and intuitive, while the backend systems should be designed to be secure, reliable, and scalable. The databases should be designed to store and retrieve payment data, as well as customer data, transaction data, and other relevant data.

Implement security measures: Security is a critical aspect of any payment system. The system needs to be designed to be secure from the ground up, with measures such as encryption, firewalls, and access controls. Compliance with industry standards, such as PCI DSS, may also be required.

Here's the video of me explaining payment system design and PSP integration in-depth 👇

Thank you for reading this edition of the newsletter!

will you share the video for subscriptions?